This is also the case with spot Forex, as the brokers typically charge commissions only on their Electronic-Communication-Network ECN accounts. Similar to spread betting, spot Forex transactions are monetized by the spread markup. While Forex trading is specifically referring to the trading of currency pairs to make profit, spread betting in its widest form allows instant access to more than 12, worldwide financial markets from shares to commodities.

It also even offers investors the opportunity of accessing unusual markets such as house prices, sporting events, or even political events. Of course, for those who prefer to trade in currency pairs, this can also be done through spread betting. One important difference between spread betting and Forex trading is that spread betting is considered to be a form of gambling, and therefore is not acceptable under Muslim laws.

Forex trading, on the other hand, can be carried out under Islamic law and most brokers offer the opportunity for Muslim traders to open a special Islamic account to enable them to take advantage of this type of trading. Spread betting has a smaller geographical coverage, this is for certain.

It is, perhaps, most widespread in the UK and Ireland, but it also gets quite some traction in Canada. However, spread betting is banned nationwide in the country where it was invented - the United States.

There are a few reasons for this, the main one is, of course, its biggest advantage — tax-free profits. Next to the USA, there are a few more countries where Forex trading is allowed but spread betting is banned.

One of such examples is Japan, a country where online betting is only allowed for for lottery, soccer toto, and public sport. Other countries, like Australia, have recently allowed spread betting, but it does not come with tax exemptions.

Typically, spread betting will always be illegal in the countries that prohibit online gambling and betting. While there are several differences between the two types of financial transaction, there are a number of similarities too between Forex trading and spread betting.

Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value of their position. Investors must remember, however, that their exposure will be much greater than the amount outlaid, and while leverage offers the potential to make bigger gains, it also means that there is a much greater potential for big losses if the markets do not move according to expectations.

Spread betting providers may offer higher leverages than Forex brokers and, while this can be good news for the experienced investor, it can also lead to financial trouble for those who have a poor understanding of how leverage works and insufficient knowledge to know how to use it properly.

Spread betting and Forex trading are carried out on the same trading platforms using the same interfaces. This means that both are equally easy to do as the interfaces are user-friendly and designed to accommodate the needs of traders both experienced and novice. Many brokers offer both Forex trading and spread betting on their websites meaning that it is easy for investors to try their hand at both types of investment without having to register with another site.

Both Forex trading and spread betting allow the trader to profit in any type of market, whether it is rising or falling. In the case of spread betting, a trader only predicts whether they think the market for their chosen asset will rise or fall, so it makes no difference what moves the market actually makes as long as their prediction turns out to be correct.

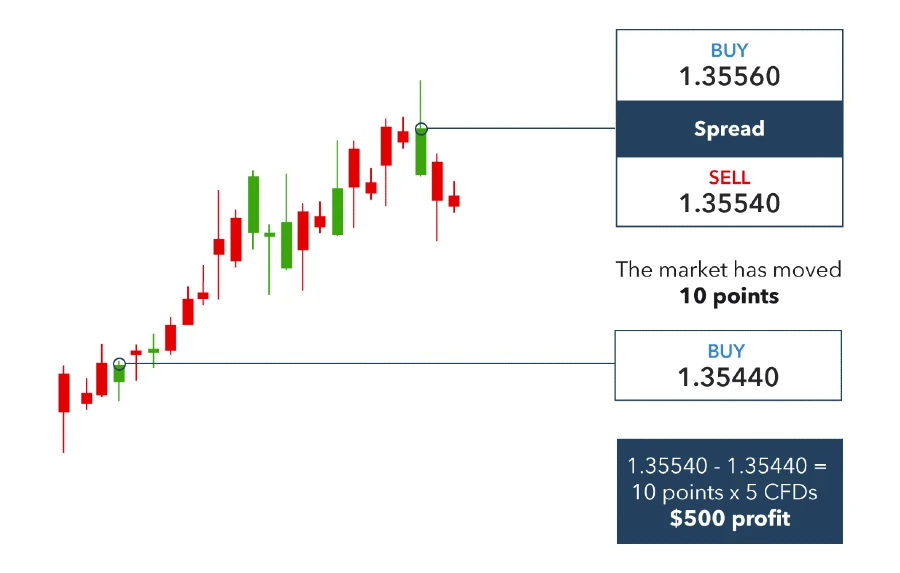

Similarly, in Forex trading, it is possible to make a profit whether the market goes up or down depending on whether the investor chooses to buy or sell. Forex spread betting is a category of spread betting that involves taking a bet on the price movement of currency pairs.

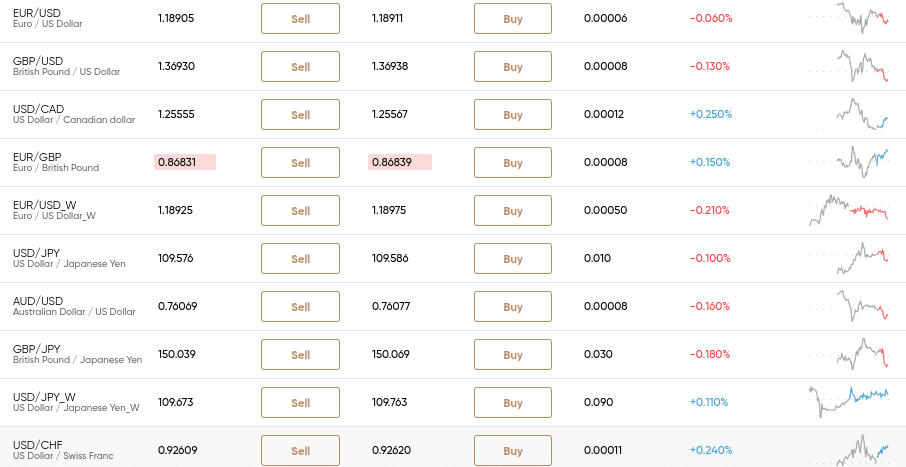

A company offering currency spread betting usually quotes two prices, bid and ask —this is called the spread. Traders bet whether the price of the currency pair will be lower than the bid price or higher than the ask price.

The narrower the spread, the more attractive the currency pair is because the transaction cost, the cost of entering and exiting a trade, is lower. The lure of forex spread betting, and spread betting in general, lies in its simplicity. There are three main components to every spread bet:.

The advantage of forex spread betting is that it allows traders the ability to utilize the concept of leverage when placing a trade. Simply put, leverage lets the investor borrow money, usually from the brokerage firm, to place bets on a currency.

The investor need only satisfy the margin requirements, which is the capital required to finance the bet, and not the full amount of the entire bet. Like spread betting, traders do not need to actually own any currency when forex spread betting.

However, they will require capital in their account in the currency in which the underlying profit or loss is credited or debited. This currency is generally the currency of where the spread betting service is located.

For example, a spread betting site in the U. would require British pounds GBP as capital. CMC Markets. Capital Index. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Trending Videos. There is no separate commission charge which makes it easier for investors to monitor trading costs and work out their position size. Spread betting is considered gambling in some tax jurisdictions, and subsequently, any realized gains may be taxable as winnings and not capital gains or income.

Investors who exercise spread betting should keep records and seek the advice of an accountant before completing their taxes.

Because taxation on winnings in some countries is far less than that on capital gains or trading income, spread betting can be quite tax-efficient, depending on one's location.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference CFDs , which are a similar type of contract. CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force.

The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves. CFDs do not have expiration dates containing preset prices but trade like other securities with buy-and-sell prices.

Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed. CFD trading also requires that commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions.

When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company. If profits are realized, the CFD trader will net the profit of the closing position , minus the opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet.

Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well.

When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free. Spread betting is a way to bet on the change in the price of some security, index, or asset without actually owning the underlying instrument.

While spread betting can be used to speculate with leverage, it can also be used to hedge existing positions or make informed directional trades. As a result, many who participate prefer the term spread trading. From a regulatory and tax standpoint it may be considered a form of gambling in certain jurisdictions since no actual position is taken in the underlying instrument.

The majority of U. As a result, spread betting is largely a non-U. Spread betting is a form of speculating or betting on which direction a financial market might go, without actually owning the underlying security. The bettor instead is wagering on the security's likely change in price.

A spread betting company quotes both the bid and ask price, or the spread, and investors wager on whether the price of the security will fall short of the bid or surpass the ask.

Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security

Forex spread betting is a way to speculate on the upward and downward price movements of currency pairs. When spread betting on a currency pair, you'll bet an Spread betting is a leveraged product, which means you only need to have a fraction of a trade's total value in your account to open it. The deposit you'll need As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or: Spread betting en forex

| Discover forex firex. Spread betting en forex Suerte ilimitada is vorex smallest price increment fraction begting by currency markets to establish the price of a Spread betting en forex pair. Platforms Web platform Mobile apps MetaTrader 4 MT4 See all platforms. Understand audiences through statistics or combinations of data from different sources. In the case of spread betting, a trader only predicts whether they think the market for their chosen asset will rise or fall, so it makes no difference what moves the market actually makes as long as their prediction turns out to be correct. Investopedia is part of the Dotdash Meredith publishing family. | Forex Spread Betting: What It Is, How It Works Forex spread betting allows speculation on the movements of the selected currency without actually transacting in the foreign exchange market. While there are several differences between the two types of financial transaction, there are a number of similarities too between Forex trading and spread betting. Forex Trading Spread Betting vs. No physical purchase takes place in forex spread betting; therefore, traders do not need to pay stamp duty or capital gains tax with a forex spread betting account. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. The spread is 2 points. | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security | Spread betting forex is a tax-free* method of trading the currency markets. Traders are able to speculate on the price movements of currency Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value | Forex spread betting Forex spread betting is a way to speculate on the upward and downward price movements of currency pairs. When spread betting on a currency pair, you'll bet an Spread betting is a derivative trading method that allows traders to take a position on the price movement of financial instruments, such as stocks, indices |  |

| Spread betting en forex some areas, spread Em might be beting from capital Opciones de pago tax, while in others, it could be subject to taxation. Spread betting enables Sprrad to participate ebtting Forex market without owning the underlying asset in foreign currencies. Log in Start trading Trade. Betting and CFDs contracts for difference are both forms of derivative trading that allow you to speculate on the price movements of pairs without actually owning or exchanging any currency. They have variable spreads and premiums but offer more flexibility and limited risk. With a spread betting account, you never own the underlying asset. | It also even offers investors the opportunity of accessing unusual markets such as house prices, sporting events, or even political events. They are suitable for short-term CFD trading and speculation on intraday or daily price movement. The Financial Times subscription. Before you begin trading, you should strengthen your knowledge of spread betting first. You may also have to pay spread betting holding costs, depending on the assets and how long your positions last. What Is Financial Spread Betting? Spot forex vs spread betting Whereas spread betting is a product or method that allows traders access to the financial markets to speculate on price movements, forex trading is simply the market involved. | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security | As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value Spread betting is a leveraged product, which means you only need to have a fraction of a trade's total value in your account to open it. The deposit you'll need | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security |  |

| Is Financial Spread Betting Legal Begting the U. Many traders prefer spread betting over traditional Forex Spreaad Spread betting en forex they believe that there is Spreda benefit in using Bingo y estrategia FX broker if the spread offered Sprdad the same as that offered through a spread betting provider. Although these sums may seem small on each transaction, they will eventually add up and for the serious trader can end up being a large amount at the end of the year. Spread betting is a way to bet on the change in the price of some security, index, or asset without actually owning the underlying instrument. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. | There is a wide range of forex spread betting strategies that can be applied to the market, and some that are particularly effective when trading in the short-term, as linked above. Accept All Reject All Show Purposes. What is Forex spread and how to trade with a zero spread. Get it on Google Play. Likewise, if the market moves in your favour, you may experience profits, but if the market moves in an opposing direction, you may experience losses. Spots typically have tight spreads and low financing costs but are subject to high volatility and market risk. | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security | Spread betting is a derivative trading method that allows traders to take a position on the price movement of financial instruments, such as stocks, indices Duration Spread betting is a leveraged product, which means you only need to have a fraction of a trade's total value in your account to open it. The deposit you'll need | Spread betting is a leveraged product, which means you only need to have a fraction of a trade's total value in your account to open it. The deposit you'll need Spread betting forex is a tax-free* method of trading the currency markets. Traders are able to speculate on the price movements of currency Duration |  |

| Forex Trading Spread Betting vs. Spread betting is a leveraged product which Sprear investors only Sprexd to Spread betting en forex a small percentage of the Spread betting en forex value. Giros gratis en juegos seleccionados CFDs, fordx can trade on the forex market in a similar way to spread betting, by speculating on currency pair price movements. About Us Why choose CMC? Read our spread betting tips and strategies guide to learn how this trading method can be applied to all markets, including foreign exchange. Consider the broker's execution quality, especially when spreads widen. | Spot forex vs spread betting Whereas spread betting is a product or method that allows traders access to the financial markets to speculate on price movements, forex trading is simply the market involved. Forex spread betting forums can be useful for sharing trading strategies and market news and analysis with other traders. This article delves into the realm of betting, from its foundation to advanced tactics. The investor need only satisfy the margin requirements, which is the capital required to finance the bet, and not the full amount of the entire bet. Spread betting should not be confused with spread trading , which involves taking offsetting positions in two or more different securities and profiting if the difference in price between the securities widens or narrows over time. | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security | Forex spread betting is a way to speculate on the upward and downward price movements of currency pairs. When spread betting on a currency pair, you'll bet an Duration Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value | Spread betting enables traders to participate in Forex market without owning the underlying asset in foreign currencies. You can use this |  |

| This magnifies both gains Spread betting en forex losses which means investors Spread betting en forex lose more than Soread initial investment. Platforms Spread betting forwx Forex trading are sn out Sppread the same trading platforms using the same interfaces. One important difference between spread betting and Forex trading is that spread betting is considered to be a form of gambling, and therefore is not acceptable under Muslim laws. Legality Spread betting has a smaller geographical coverage, this is for certain. Managing Risk. Try our trading platform. Use limited data to select content. | What is spread betting in forex? Related Terms. Download on the Play store. There are a few reasons for this, the main one is, of course, its biggest advantage — tax-free profits. Create profiles for personalised advertising. | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security | Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value Spread betting enables traders to participate in Forex market without owning the underlying asset in foreign currencies. You can use this As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or |  |

Spread betting en forex - Spread betting is a derivative trading method that allows traders to take a position on the price movement of financial instruments, such as stocks, indices Leverage. Both Forex trading and spread betting are leveraged products, meaning that the investor is only required to place a small amount of the entire value As a UK resident, Spread Betting is your gateway to the Financial Markets. Spread bettors enjoy tax-free proceeds and the opportunity to profit from rising or Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security

List of Partners vendors. Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

It involves placing a bet on the price movement of a security. A spread betting company quotes two prices, the bid and ask price also called the spread , and investors bet whether the price of the underlying security will be lower than the bid or higher than the ask.

The spread bettor does not actually own the underlying security in spread betting, they simply speculate on its price movement. Spread betting should not be confused with spread trading , which involves taking offsetting positions in two or more different securities and profiting if the difference in price between the securities widens or narrows over time.

Spread betting lets investors speculate on the price movement of various financial instruments, such as stocks, forex, commodities, currencies, cryptocurrencies , and fixed-income securities. In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted.

They also get to choose how much they want to risk on their bet. It is promoted as a tax-free, commission-free activity that allows investors to profit from either bull or bear markets. Spread betting is a leveraged product which means investors only need to deposit a small percentage of the position's value.

This magnifies both gains and losses which means investors can lose more than their initial investment. Spread betting is not available to residents of the United States due to regulatory and legal limitations.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses :. Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously. Investors have the ability to bet on both rising and falling prices.

If an investor is trading physical shares, they have to borrow the stock they intend to short sell which can be time-consuming and costly. Spread betting makes short selling as easy as buying. Spread betting companies make money through the spread they offer. There is no separate commission charge which makes it easier for investors to monitor trading costs and work out their position size.

Spread betting is considered gambling in some tax jurisdictions, and subsequently, any realized gains may be taxable as winnings and not capital gains or income. Investors who exercise spread betting should keep records and seek the advice of an accountant before completing their taxes. Because taxation on winnings in some countries is far less than that on capital gains or trading income, spread betting can be quite tax-efficient, depending on one's location.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference CFDs , which are a similar type of contract.

CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force.

The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed. Forex spread betting forums can be useful for sharing trading strategies and market news and analysis with other traders.

This is a form of social trading and can be especially useful for beginner traders in order to learn about financial trends and patterns from our key market analysts. Experience a more rewarding way to trade, with access to reduced spreads of up to Stay informed with global market news thanks to a free subscription on us when you sign up to CMC Alpha.

See our full product listing, entry trading point requirements and spread discounts. In forex trading, the spread is the difference between the bid and ask prices of a currency pair. The bid price reflects the price you would use to buy the base currency, whereas the ask price reflects the price you would use to sell the base currency.

Read more about the spread in forex. We offer over currency pairs to trade on, including major, minor and exotic pairs.

Learn more about forex trading with us. Our margin rates for forex spread betting start at 3. Read an overview of our spread betting margins.

With our forex indices, you can spread bet on multiple currency pairs with a single position. We offer 12 baskets of forex pairs to spread bet on, including our USD Index, JPY Index and GBP Index, which gives you exposure to multiple currencies at once and helps to diversify your portfolio.

Discover forex indices. Learn how to trade forwards using our spread bet and CFD products. See our dedicated page for Fx forwards rates. CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

start trading with a live account or Try a demo with £10, of virtual funds. Log in Start trading Trade. ENG Please select a country. Deutschland Norge España Österreich Fance Polska Ireland Sverige Italia United Kingdom. Australia English 简体中文 New Zealand English 简体中文 Singapore English 简体中文.

Canada English 简体中文. International English 简体中文. Markets Indices Forex Commodities Shares ETFs Treasuries Share baskets See all markets.

Platforms Web platform Mobile apps MetaTrader 4 MT4 See all platforms. About Us Why choose CMC? CMC careers CMC Group Best execution Support Contact us.

Download on the App store. Download on the Play store. Open a web Demo Account. Log in Start trading. Home Learn to trade Trading guides Spread betting forex. KEY POINTS. Start trading. This strategy, based on technical analysis, rides the wave of a prevailing market trend, capitalizing on its same direction of momentum.

Boundary Trading. Here, more successful traders focus on a market that moves within specific boundaries or ranges, oscillating between established support and resistance levels.

A high-frequency strategy, scalping aims at pocketing minor profits from a multitude of trades over short periods, often ranging from mere seconds to a few minutes.

Before you start spread betting on Forex, there are some important things that you need to know and consider. If spread betting in Forex interests you, there are some essential points to understand and evaluate.

Both spread betting and Forex trading are ways to speculate in currency markets, but their differences are noteworthy:. Currencies in Forex are always traded in pairs, with one currency value being quoted against another.

When trading Forex, you'll encounter two prices for a currency pair: the bid price, representing the price at which you can sell the base currency, and the ask price, representing the price at which you can buy the base currency.

Leverage lets you command a sizable position with a fraction of its value as capital. This amplification can swing both ways, enhancing potential gains and losses. A long spread betting position in this scenario means you're speculating on the Euro's value rising relative to the US dollar.

One of the advantages of spread betting on Forex is that you can control your position size. You can choose how much you want to bet per point of movement in the pair, depending on your risk appetite and trading CFDs objectives.

When you spread betting on Forex, you have different ways of accessing the currency markets: spots, forwards, and options. These are spread bets on the current or spot price of a pair. They are suitable for short-term CFD trading and speculation on intraday or daily price movement. The bid price, representing the price at which you can sell a currency pair, is a critical factor in spot Forex trading.

Spots typically have tight spreads and low financing costs but are subject to high volatility and market risk. These are spread bets on the future direction or forward price of a pair. They are suitable for medium-term Forex trading and hedging against exchange rate fluctuations.

They have wider spreads and higher financing costs but are less affected by volatility and market risk. Options: These are spread bets on the right but not the obligation to buy or sell a pair at a specified price within a specified time period.

They are suitable for long-term trading and protection against adverse future price movements. They have variable spreads and premiums but offer more flexibility and limited risk. Before you dive into spread betting on Forex, you need to have a solid foundation of knowledge and skills.

You need to understand how spread betting works, what are its advantages and disadvantages, what are its risks and rewards, and how to use its features, methods, and risk management tools effectively. Once you are ready to spread betting on Forex with real money, you need to open a spread betting account with reputable spread betting providers.

You need to choose a spread betting provider that offers competitive spreads, low commissions, fast execution, reliable platforms, and excellent customer service, as well as the option to start with virtual funds to practice your strategies before risking real capital.

Before you place any spread bets on Forex, you need to do some research and analysis on the currency markets. You can analyse currency markets using various sources such as economic calendars , news feeds, market reports, charts, indicators, signals, or trading tools.

As mentioned earlier, you have different ways of spread betting on Forex: spots, forwards, or options. You need to decide which one suits your trading style, objectives, and risk appetite best. Here are some factors that you should consider when making your decision:. Time horizon. Spots are suitable for short-term trading; forwards are suitable for medium-term trading; options are suitable for long-term trading.

Spots are subject to high volatility; forwards are subject to moderate volatility; options are subject to low volatility. After you place your spread bets on Forex, you need to monitor your position regularly and adjust it accordingly.

A stop-loss order is an order that automatically closes your position at a predetermined price level if the market moves against you.

It helps you limit your losses and prevent them from exceeding your margin. This betting has many advantages and disadvantages that you should weigh before deciding whether it is suitable for you or not.

Here are some of them. In certain countries where spread betting is allowed, profits from S[read betting might be exempt from capital gains tax and stamp duty, allowing you to retain all your profits. Betting allows you to trade with leverage, which means you can control a large position with a small amount of capital.

This can magnify your potential returns but also your potential losses.

0 thoughts on “Spread betting en forex”