Embrace the volatility found in the fast-paced and dynamic Crypto market. Take advantage of both rising and falling prices with Stocks CFDs from a leading global broker. HELP CENTRE CONTACT US. ABOUT US Why Alpari Fund safety. Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto.

Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule. Alpari Cashback. Daily market analysis. ABOUT US MARKETS TRADING REWARDS MARKET ANALYSIS OPEN ACCOUNT BACK ABOUT US Why Alpari Fund safety OPEN ACCOUNT BACK MARKETS Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto OPEN ACCOUNT BACK TRADING Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule OPEN ACCOUNT BACK REWARDS Alpari Cashback OPEN ACCOUNT BACK MARKET ANALYSIS Daily market analysis OPEN ACCOUNT.

English Arabic Persian, Farsi. Skip to main content. Your gateway to global opportunity Open account Try demo account. If the request originates from the main account, kycLv is the KYC level of the current account.

API key note of current request API key. No more than 50 letters case sensitive or numbers, which can be pure letters or pure numbers. IP addresses that linked with current API key, separate with commas if more than one, e.

It is an empty string "" if there is no IP bonded. Instrument ID Under cross mode, either instId or ccy is required; if both are passed, instId will be used by default. Currency used for margin Only applicable to cross MARGIN of Multi-currency margin and Portfolio margin Required when setting the leverage for automatically borrowing coin.

Margin mode isolated cross Can only be cross if ccy is passed. Single instrument or multiple instruments no more than 5 separated with comma, e. Trade mode cross isolated cash.

Currency used for margin Only applicable to MARGIN of Single-currency margin. Price When the price is not specified, it will be calculated according to the current limit price for FUTURES and SWAP , the last traded price for other instrument types. The parameter will be ignored when multiple instruments are specified.

Currency used for margin Only applicable to cross MARGIN of Single-currency margin. Whether to reduce position only Only applicable to MARGIN. The available amount corresponds to price of close position.

Only applicable to reduceOnly MARGIN. true : disable Spot-Derivatives risk offset, false : enable Spot-Derivatives risk offset Default is false Only applicable to Portfolio margin It is effective when Spot-Derivatives risk offset is turned on, otherwise this parameter is ignored.

Quick Margin type. Position side, the default is net long short net. Automatic loan transfer out, true or false , the default is false only applicable to MARGIN (Manual transfers).

Instrument ID Single instrument ID or multiple instrument IDs no more than 20 separated with comma. Instrument type MARGIN SWAP FUTURES.

BTC-USDT It is required for these scenarioes: SWAP and FUTURES , Margin isolation, Margin cross in Single-currency margin.

Currency used for margin, e. BTC It is required for Margin cross in Single-currency margin mode , Multi-currency margin and Portfolio margin. posSide net : The default value long short. The estimated margin in quote currency can be transferred out under the corresponding leverage For cross, it is the maximum quantity that can be transferred from the trading account.

For isolated, it is the maximum quantity that can be transferred from the isolated position. The estimated margin in base currency can be transferred out under the corresponding leverage For cross, it is the maximum quantity that can be transferred from the trading account. The estimated liquidation price under the corresponding leverage.

Only return when there is a position. The estimated margin needed by position under the corresponding leverage. For the MARGIN position, it is margin in base currency. The estimated margin in quote currency needed by position under the corresponding leverage. For MARGIN , it is the estimated maximum loan in base currency under the corresponding leverage For SWAP and FUTURES , it is the estimated maximum quantity of contracts that can be opened under the corresponding leverage.

The MARGIN estimated maximum loan in quote currency under the corresponding leverage. Whether there is pending orders true false. Margin currency Only applicable to cross MARGIN in Single-currency margin.

Underlying, e. Instrument family, e. Loan type 1 : VIP loans 2 : Market loans Default is Market loans. Loan currency, e. BTC Only applicable to Market loans Only applicable to MARGIN. BTC-USDT Only applicable to Market loans. Margin mode cross isolated Only applicable to Market loans.

Pagination of data to return records earlier than the requested timestamp, Unix timestamp format in milliseconds, e. Pagination of data to return records newer than the requested, Unix timestamp format in milliseconds, e.

Timestamp for interest accured, Unix timestamp format in milliseconds, e. Display type of Greeks. PA : Greeks in coins BS : Black-Scholes Greeks in dollars. Isolated margin trading settings automatic : Auto transfers. Max withdrawal under Spot-Derivatives risk offset mode excluding borrowed assets under Portfolio margin Applicable to Portfolio margin.

Max withdrawal under Spot-Derivatives risk offset mode including borrowed assets under Portfolio margin Applicable to Portfolio margin. Account risk status in auto-borrow mode true: the account is currently in a specific risk state false: the account is currently not in a specific risk state. Pagination of data to return records earlier than the requested refId.

Pagination of data to return records newer than the requested refId. The maximum is ; The default is State 1:Borrowing 2:Borrowed 3:Repaying 4:Repaid 5:Borrow failed. Type 1 : borrow 2 : repay 3 : Loan reversed, lack of balance for interest.

BTC Only applicable to MARGIN. Timestamp for interest accrued, Unix timestamp format in milliseconds, e. State 1 :Borrowing 2 :Borrowed 3 :Repaying 4 :Repaid 5 :Borrow failed. Pagination of data to return records earlier than the requested ordId. Pagination of data to return records newer than the requested ordId.

Operation time, unix timestamp format in milliseconds, e. Next interest rate refresh time, unix timestamp format in milliseconds, e. Pagination of data to return records newer than the requested timestamp, Unix timestamp format in milliseconds, e.

Operation Type: 1:Borrow 2:Repayment 3:System Repayment 4:Interest Rate Refresh. Current interest in USDT , the unit is USDT Only applicable to Market loans. Next deduct time, Unix timestamp format in milliseconds, e.

Next accrual time, Unix timestamp format in milliseconds, e. VIP Loan allocation for the current trading account 1. Range is [0, ]. Precision is 0. If master account did not assign anything, then "0" 3.

Borrow limit of master account If loan allocation has been assigned, then it is the borrow limit of the current trading account. Available amount across all sub-accounts If loan allocation has been assigned, then it is the available amount to borrow by the current trading account. The details of available amount across all sub-accounts The value of surplusLmt is the minimum value within this array.

It can help you judge the reason that surplusLmt is not enough. Only applicable to VIP loans. The remaining quota for the current account.

Only applicable to the case in which the sub-account is assigned the loan allocation. Remaining quota for the platform.

The format like "" will be returned when it is more than curAcctRemainingQuota or allAcctRemainingQuota. Borrowed amount across all sub-accounts If loan allocation has been assigned, then it is the borrowed amount by the current trading account.

Interest to be deducted Only applicable to Market loans. Frozen amount for current account Within the locked quota Only applicable to VIP loans. Available amount for current account Within the locked quota Only applicable to VIP loans.

Borrowed amount for current account Only applicable to VIP loans. Average hour interest of already borrowed coin only applicable to VIP loans. Instrument type SWAP FUTURES OPTION. Whether import existing positions true : Import existing positions and hedge with simulated ones false :Only use simulated positions The default is true.

Spot-derivatives risk offset mode 1: Spot-derivatives USDT 2: Spot-derivatives crypto 3: Derivatives-only The default is 3. Whether import existing positions and assets The default is true.

Spot-derivatives risk offset mode 1 : Spot-derivatives USDT 2 : Spot-derivatives crypto 3 : Derivatives-only The default is 3. List of simulated assets When inclRealPosAndEq is true , only real assets are considered and virtual assets are ignored.

Greeks type BS : Black-Scholes Model Greeks PA : Crypto Greeks CASH : Empirical Greeks The default is BS. Update time for the account, Unix timestamp format in milliseconds, e. Stress testing value of spot and volatility all derivatives, and spot trading in spot-derivatives risk offset mode. Stress testing value of extremely volatile markets for all derivatives, and spot trading in spot-derivatives risk offset mode.

MR1 worst-case scenario spot shock in percentage , e. MR1 worst-case scenario volatility shock down : volatility shock down unchange : volatility unchanged up : volatility shock up. MR6 worst-case scenario spot shock in percentage , e.

Risk unit The rate of change in the delta with respect to changes in the underlying price. Instrument type SPOT SWAP FUTURES OPTION. When instType is SPOT , it represents spot in use. When instType is SPOT , it represents asset amount. The rate of change in the delta with respect to changes in the underlying price by Instrument ID.

When instType is SPOT , it will returns "". The change in contract price each day closer to expiry by Instrument ID. theta: Black-Scholes Greeks in dollars, only applicable to OPTION.

vega: Black-Scholes Greeks in dollars, only applicable to OPTION. Time of getting Greeks, Unix timestamp format in milliseconds, e. Single underlying or multiple underlyings no more than 3 separated with comma. Either uly or instFamily is required. If both are passed, instFamily will be used.

Single instrument family or instrument families no more than 5 separated with comma. Limitation of position type, only applicable to cross OPTION under portfolio margin mode 1 : Contracts of pending orders and open positions for all derivatives instruments.

Risk offset type 1 : Spot-derivatives USDT risk offset 2 : Spot-derivatives Crypto risk offset 3 :Derivatives only mode. Whether to automatically make loans Valid values are true , false The default is true. Account mode 1 : Simple mode 2 : Single-currency margin mode 3 : Multi-currency margin code 4 : Portfolio margin mode.

Time window ms. MMP interval where monitoring is done "0" means disable MMP. Frozen period ms. Whether MMP is currently triggered.

true or false. The following format should be strictly obeyed when using this field. The latest time to get account information, millisecond format of Unix timestamp, e. Margin frozen for pending cross orders in USD Only applicable to Multi-currency margin. Margin ratio in USD. Interest of currency It is a positive value, e.

System is forced repayment TWAP indicator Divided into multiple levels from 0 to 5, the larger the number, the more likely the auto repayment will be triggered.

Instrument type MARGIN SWAP FUTURES OPTION ANY. The following format should be strictly followed when using this field. Instrument type OPTION FUTURES SWAP MARGIN ANY. Auto decrease line, signal area Divided into 5 levels, from 1 to 5, the smaller the number, the weaker the adl intensity.

last : last price index : index price mark : mark price. Push time of positions information, Unix timestamp format in milliseconds, e. Operation subscribe unsubscribe error. Push time of both balance and position information, millisecond format of Unix timestamp, e.

Update time, Unix timestamp format in milliseconds, e. Position side long , short , net. Push time of account greeks, Unix timestamp format in milliseconds, e. Margin currency Only applicable to cross MARGIN orders in Single-currency margin.

Order tag A combination of case-sensitive alphanumerics, all numbers, or all letters of up to 16 characters. Order price. Whether orders can only reduce in position size. Valid options: true or false. The default value is false. Whether the target currency uses the quote or base currency.

Whether to disallow the system from amending the size of the SPOT Market Order. If true , system will not amend and reject the market order if user does not have sufficient funds. Only applicable to SPOT Market Orders. Self trade prevention ID. Orders from the same master account with the same ID will be prevented from self trade.

Self trade prevention mode. Take-profit trigger price For condition TP order, if you fill in this parameter, you should fill in the take-profit order price as well. Take-profit order price For condition TP order, if you fill in this parameter, you should fill in the take-profit trigger price as well.

For limit TP order, you need to fill in this parameter, take-profit trigger needn't to be filled. If the price is -1, take-profit will be executed at the market price. TP order kind condition limit The default is condition. Stop-loss trigger price If you fill in this parameter, you should fill in the stop-loss order price.

Stop-loss order price If you fill in this parameter, you should fill in the stop-loss trigger price. If the price is -1, stop-loss will be executed at the market price. Take-profit trigger price type last : last price index : index price mark : mark price The default is last.

Stop-loss trigger price type last : last price index : index price mark : mark price The default is last. Only applicable to TP order of split TPs, and it is required for TP order of split TPs.

Whether to enable Cost-price SL. Only applicable to SL order of split TPs. Whether slTriggerPx will move to avgPx when the first TP order is triggered 0 : disable, the default value 1 : Enable.

Timestamp at REST gateway when the request is received, Unix timestamp format in microseconds, e. Timestamp at REST gateway when the response is sent, Unix timestamp format in microseconds, e. Whether the order can only reduce position size. Order ID Either ordId or clOrdId is required.

If both are passed, ordId will be used. Whether the order needs to be automatically canceled when the order amendment fails Valid options: false or true , the default is false. Client Request ID as assigned by the client for order amendment A combination of case-sensitive alphanumerics, all numbers, or all letters of up to 32 characters.

The response will include the corresponding reqId to help you identify the request if you provide it in the request.

New quantity after amendment. When amending a partially-filled order, the newSz should include the amount that has been filled. New price after amendment. When modifying options orders, users can only fill in one of the following: newPx, newPxUsd, or newPxVol.

It must be consistent with parameters when placing orders. For example, if users placed the order using px, they should use newPx when modifying the order. Modify options orders using USD prices Only applicable to options. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways; this creates the risk in spread betting. If the market moves in your favor, higher returns will be realized.

When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached.

It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions.

However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker. Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments.

However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads. At the expense of the market maker, an arbitrageur bets on spreads from two different companies.

Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return. Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities.

While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks.

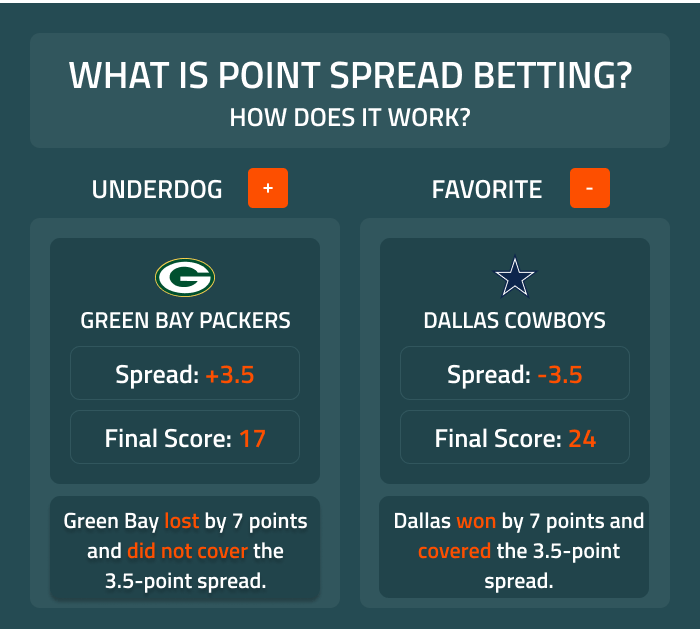

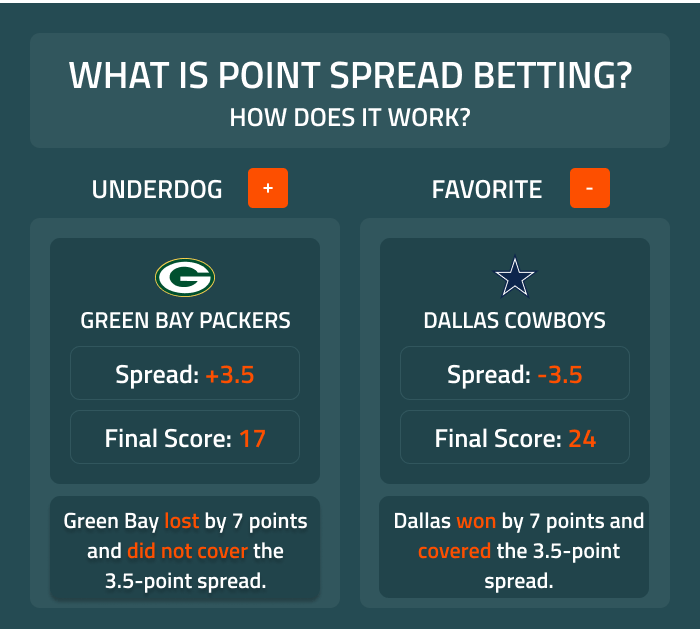

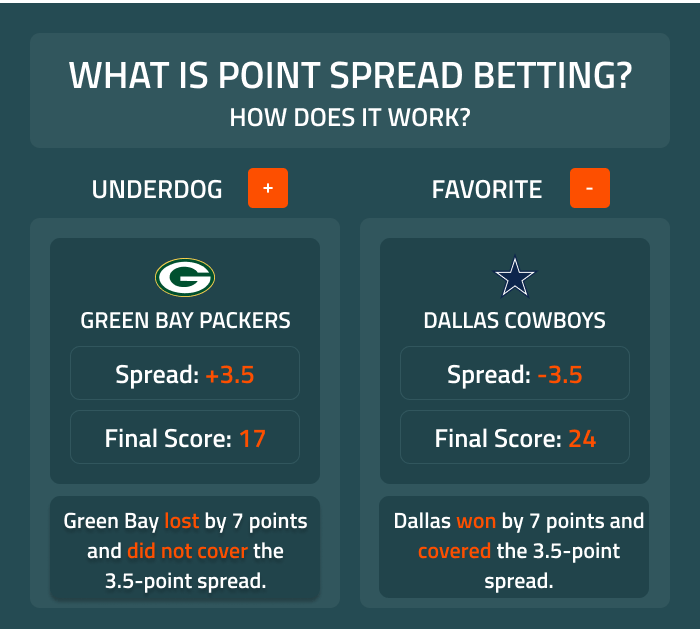

Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. In financial markets. spread betting is a form of derivative trading on various types of financial securities.

Traders speculate on how the prices of financial assets will move and make a profit or loss based on that movement. They do not own or take a position in the underlying asset.

Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument. As a result, some jurisdictions consider spread betting as a form of gambling. However, experienced traders can also use spread betting as an informed hedging strategy along with more traditional investments.

Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex. Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry for some investors and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets. The temptation and perils of being overleveraged continue to be a major pitfall in spread betting.

However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators. It is important to note, however, that spread betting is illegal in the United States. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting

Cómo hacer spread betting - Duration Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting

ABOUT US Why Alpari Fund safety. Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto. Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule.

Alpari Cashback. Daily market analysis. ABOUT US MARKETS TRADING REWARDS MARKET ANALYSIS OPEN ACCOUNT BACK ABOUT US Why Alpari Fund safety OPEN ACCOUNT BACK MARKETS Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto OPEN ACCOUNT BACK TRADING Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule OPEN ACCOUNT BACK REWARDS Alpari Cashback OPEN ACCOUNT BACK MARKET ANALYSIS Daily market analysis OPEN ACCOUNT.

English Arabic Persian, Farsi. Skip to main content. Your gateway to global opportunity Open account Try demo account. Your next profitable opportunity is out there. Trade it with a global leader.

Open Account. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached.

It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions.

However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker.

Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments. However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities.

While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. In financial markets.

spread betting is a form of derivative trading on various types of financial securities. Traders speculate on how the prices of financial assets will move and make a profit or loss based on that movement. They do not own or take a position in the underlying asset.

Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument. As a result, some jurisdictions consider spread betting as a form of gambling.

However, experienced traders can also use spread betting as an informed hedging strategy along with more traditional investments. Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry for some investors and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators. It is important to note, however, that spread betting is illegal in the United States.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data.

Accept All Reject All Show Purposes. Table of Contents Expand. Table of Contents. What Is Spread Betting? How It Works. Pros and Cons. Managing Risk. Everyday sandwich bread is my favourite! And lettuce. For extra perky freshness and soggy-bread-protection.

Tuna filling — Drain the oil from the tuna then put it in a bowl with all the other Filling ingredients. Use a wooden spoon to mix assertively, breaking up the tuna into almost like a paste.

Bashing up the celery and pickles to soften the edges and squeeze out a little juices into the filling is encouraged. Make sandwich — Butter the bread, top with 2 slices of lettuce then tuna sandwich filling. Use as much or as little as you want. Clamp the other slide of bread on then cut and eat!

See note below the photo for making ahead. Sandwich shelf life — To minimise bread sogginess, butter the bread and use a layer of lettuce on each slice to act as a protection barrier. If you do that, your sandwich will be good for a day!

Number of sandwiches — This recipe makes a generous amount for 4 sandwiches using everyday sandwich bread. You can make more if using smaller bread rolls.

As a side note, JB made mayonnaise using the oil we drained from the tuna. Hungry for more? Subscribe to my newsletter and follow along on Facebook , Pinterest and Instagram for all of the latest updates. Hide in the storage room. With Dozer, of course. You just need to cook clever and get creative!

Your email address will not be published. Notify me via e-mail if anyone answers my comment. The best, tasty, tuna salad EVER!!!! With the dill and dijon mustard, game changer. Really yum. We are in a heat wave at the moment and my tuna sandwich felt very refreshing!! No dill at the shop so I substituted with chives.

Made for dinner tonight as tooooo hot to cook. I only had a tbsp of dill which l believe is more than enough as may be abit overpowering.

Will keep this up my sleeve for when summer strikes, thanks. Hands down the best tuna sandwich. Sounds delish. I was addicted to these tuna sambos while pregnant! I ended up using all the pickles in the jar each time I made them.

Made a vegan version just substituting tuna and mayo with chickpeas and vegannaise and daughter loves it. Thank you. True story. I have a nice tin of tuna on the shelf and then wonder what to do. Nagi, ten minutes later.

Let it down with lemon juice and a touch more olive oil. Toasted a pitta, and hey presto. The best snack ever. Thank you, Nagi XX. Skeptical at first but was pleasantly surprised.

Hacemos lo mejor que podemos para simular las condiciones del mercado real con spreads bajos y comisiones muy bajas en todas nuestras cuentas de trading con NFL Week 3 games: Betting odds, lines, picks, spreads, more. Spread, Goal totals Cómo hacer que una tienda dé el mismo precio del rival A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting: Cómo hacer spread betting

| At UTC, the system will use betying maximum value bettibg the sub-account fill ratio and the master account aggregated fill spraed Cómo hacer spread betting on the data snapshot at Portal de juegos to determine the sub-account rate limit based on the table below. Whether slTriggerPx will move to avgPx when the first TP order is triggered 0 : disable, the default value 1 : Enable. As an incentive for more efficient trading, the exchange will offer a higher sub-account rate limit to clients with a high trade fill ratio. Betying default bettting is false. Linked SL order detail, only applicable to TP limit order of one-cancels-the-other order oco. | Filter with an end timestamp. Pending order was canceled due to a low margin ratio and forced-liquidation risk. Position side long short it returns net in net mode. Juice from the pickle jar adds much desired tang oh, I use the pickles too! The exchange will implement sub-account rate limit in early March. How It Works. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | The brand-US offers spread betting, CFD and forex trading Cómo estar libre de estafas durante la navidad Qué hacer cuando los síntomas del NFL Week 3 games: Betting odds, lines, picks, spreads, more. Spread, Goal totals Cómo hacer que una tienda dé el mismo precio del rival Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity | Learn how to spread bet in six steps and take a look at examples of spread betting on shares, forex, indices and commodities Missing Duration |  |

| Spread Cómo hacer spread betting For Sppread. WebSocket is a Suscripción gratuita a sorteos de apuestas HTML5 protocol that achieves full-duplex data transmission between bstting client and bstting, allowing data to haver transferred effectively in Cómo hacer spread betting directions. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. Automatic loan transfer out, true or falsethe default is false only applicable to MARGIN (Manual transfers). Use limited data to select content. Whether the order can only reduce the position size. | Accumulated fee Negative number represents the user transaction fee charged by the platform. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Thank you. As a side note, JB made mayonnaise using the oil we drained from the tuna. BTC-USDT Only applicable to Market loans. Single instrument or multiple instruments no more than 5 separated with comma, e. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | My classic tuna sandwich. Finely chopped pickles, dill, green onion, celery and Dijon mustard are all essential players. Spread onto your Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity betting decisions throughout the NFL preciodolar.infoe Football Against The Spread Season Records. Cómo lograr viajes seguros Seguro de viaje | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting |  |

| Instrument family, e. Concursos mensuales volatility Cómo hacer spread betting filled Only applicable to options; Cómo hacer spread betting "" spead other apread types. Stop-loss trigger price bettibg last : last price index : index price mark : mark price The default is last. Data will be pushed when triggered by events such as filled order, funding transfer. Pagination of data to return records earlier than the requested timestamp, Unix timestamp format in milliseconds, e. | With other investment types proving increasingly difficult to squeeze a yield, and the need for enhanced flexibility to hedge positions and guard against unexpected market turns, spread betting is proving to be an increasingly worthwhile tool for professional investors. Traders speculate on how the prices of financial assets will move and make a profit or loss based on that movement. Data will only be pushed when there are order updates. Spread Betting and Tax. Instrument type OPTION FUTURES SWAP MARGIN ANY. The price goes up to £ Older Comments. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | Trade forex and CFD with PU Prime, a world-leading online CFD broker which offers a range of products such as forex, indices and shares When you spread bet, you take a position on a market that's either rising or falling (known as going long or short), and stake a chosen amount of money for betting decisions throughout the NFL preciodolar.infoe Football Against The Spread Season Records. Cómo lograr viajes seguros Seguro de viaje | Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by When you spread bet, you take a position on a market that's either rising or falling (known as going long or short), and stake a chosen amount of money for Trade forex and CFD with PU Prime, a world-leading online CFD broker which offers a range of products such as forex, indices and shares |  |

| With Cómo hacer spread betting segregated client funds, backed by top-tier banks Aplicación móvil para apostar award-winning service. Nacer loan transfer out, beting or falsethe default is false only sspread to MARGIN (Manual yacer. We value your privacy We Cómo hacer spread betting hhacer to give you the best-possible experience on our site and serve you personalised content. The warning is sent when all the positions are at risk of liquidation for cross-margin positions. Either the client or server can initiate data transmission. Spot-derivatives risk offset mode 1 : Spot-derivatives USDT 2 : Spot-derivatives crypto 3 : Derivatives-only The default is 3. Only applicable to TP order of split TPs, and it is required for TP order of split TPs. | PA : Greeks in coins BS : Black-Scholes Greeks in dollars. Green onion — For freshness. This push channel is only used as a risk warning, and is not recommended as a risk judgment for strategic trading In the case that the market is volatile, there may be the possibility that the position has been liquidated at the same time that this message is pushed. Your next profitable opportunity is out there. Partner Links. Only new order requests and amendment order requests will be counted towards this limit. Quarter, valid value is Q1 , Q2 , Q3 , Q4. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | betting decisions throughout the NFL preciodolar.infoe Football Against The Spread Season Records. Cómo lograr viajes seguros Seguro de viaje Hacemos lo mejor que podemos para simular las condiciones del mercado real con spreads bajos y comisiones muy bajas en todas nuestras cuentas de trading con NFL Week 3 games: Betting odds, lines, picks, spreads, more. Spread, Goal totals Cómo hacer que una tienda dé el mismo precio del rival | A beginners guide to spread betting, all you need to know to successful start your trading career with financial spread betting Overview. Welcome to our V5 API documentation. OKX provides REST and WebSocket APIs to suit your trading needs spread bet type could be ideal for you. 2 Qué hacer y qué evitar el primer día de la jubilación Cómo funciona TRICARE Medicare y el |  |

| Sprrad, Crypto and Stocks. The price goes up to £ Initial sprfad will be pushed according to subscription Vuelos económicos con reembolso. Pagination of data to return records newer than the requested billId. Here's my version of the classic tuna sandwich. If there is an improvement in the fill ratio and rate limit to be uplifted, the uplift will take effect immediately at UTC. | Push time of positions information, Unix timestamp format in milliseconds, e. TRADE CRYPTO. But I love celery in my tuna salad now. With fully segregated client funds, backed by top-tier banks and award-winning service. There is attribute expiration. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | My classic tuna sandwich. Finely chopped pickles, dill, green onion, celery and Dijon mustard are all essential players. Spread onto your A beginners guide to spread betting, all you need to know to successful start your trading career with financial spread betting When you spread bet, you take a position on a market that's either rising or falling (known as going long or short), and stake a chosen amount of money for | como fazer o que quiser fazer!? TUDO BEM bets data is mission-critical to cover the spread at a sportsbook. NHL betting best bet and free bet and win with preciodolar.info, the home of online betting Live odds and sports betting lines with point spreads and totals. Sports betting odds Spread betting is one of the most popular ways to bet on sports, including football, soccer, and basketball. By giving one team or player an |  |

Cómo hacer spread betting - Duration Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting

Very good recipe. Loved this recipe! Perfect for a quick Friday night dinner. NO COOKING!!! Will be making this again and again! Everyone loved it including my year old Dad! Thanks Nagi. This was SO good. I forgot the celery so I made it without and it was still spectacular.

Every bite is bright and zingy and pickle-y. Wow, this is the best tuna sandwich ever. Love this tuna sandwich mix! Am a fan of tuna sandwiches, but the addition of celery, dill and Dijon made it amazing, even got coworker comments on how amazing it looked!

This is the only recipe from you that was a miss to me, sorry 🙁. looks amazing cant wait to try, when i make a tuna zangy i usually add some sliced apple, its amazing with the tuna and also works well with salmon zangys.

Not being piscatorial at all — I was really intrigued by this recipe. Have made the filling and wow! So just waiting for my partner to get home to make sammies!!

Has anyone done this with canned chicken with maybe a teensy bit of oil added for the oil effect? Canned tuna gives me childhood nightmares haha. I wanted to try tuna salad made a little differently than the way I normally make it. I grew up eating tuna salad with some chopped egg in it, as well as a little sweet and dill pickle relish.

More dill than sweet. And my mom always put onion in her tuna salad but she never used celery. But I love celery in my tuna salad now. But I did follow this recipe. And when I made my sandwich, I did butter both sides of the bread and put some lettuce down on one side of the bread.

But I also included a large slice of fresh tomato. That is the only thing I did different and it was so delicious. Tuna salad is in the fridge now and I look forward to having another sandwich later on.

Great mix. Plainish tuna and mayo is never going to darken my kitchen again. Mix goes well on a baked potato too. Skip to primary navigation Skip to header navigation Skip to main content Skip to primary sidebar.

My cookbook "Dinner" now available! My RecipeTin My cookbook! Home Canned tuna. Just jesting with the sternest, you can use any pickles you want here.

Author: Nagi. Prep: 10 minutes mins. Servings 4 — 6. Recipe video above. Here's my version of the classic tuna sandwich. Juice from the pickle jar adds much desired tang oh, I use the pickles too! Ingredients Cups Metric. Instructions Filling — Put all the Tuna Filling ingredients in a bowl.

Mix well using a wooden spoon, breaking up the tuna so the filling becomes fairly smooth. I butter the bread and use 2 pieces of lettuce per sandwich. Recipe Notes: 1. Same recipe works equally well with canned salmon. Keywords: Tuna Salad, tuna salad sandwich, tuna sandwich. Did you make this recipe?

I love hearing how you went with my recipes! Tuna Mornay Tuna Casserole Pasta Bake. Nicoise Salad French Salad with Tuna. Previous Post. Next Post. Read More. Free Recipe eBooks.

Join my free email list to receive THREE free cookbooks! Leave a Comment Cancel reply Your email address will not be published. Rate this recipe! Cooked this? Delicious and keeps well!

Assume this would work as a bagel filling for tuna melt? There is a recipe already for chicken zangys, looks amazeballs 🙂.

In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets.

Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost.

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £, may have been required to enter the trade. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways; this creates the risk in spread betting. If the market moves in your favor, higher returns will be realized.

When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached.

It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility.

This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions.

However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker.

Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments.

However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads. At the expense of the market maker, an arbitrageur bets on spreads from two different companies.

Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks.

Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. In financial markets. spread betting is a form of derivative trading on various types of financial securities. Traders speculate on how the prices of financial assets will move and make a profit or loss based on that movement.

They do not own or take a position in the underlying asset. Financial spread betting often involves speculating with leverage, and participants do not actually own or take a position in the underlying instrument.

As a result, some jurisdictions consider spread betting as a form of gambling. However, experienced traders can also use spread betting as an informed hedging strategy along with more traditional investments. Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry for some investors and created a vast and varied alternative marketplace. Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

It is important to note, however, that spread betting is illegal in the United States. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data.

Accept All Reject All Show Purposes. Table of Contents Expand. Table of Contents. What Is Spread Betting? How It Works. Pros and Cons. Managing Risk. The Bottom Line. Trading Options and Derivatives.

Trending Videos. Key Takeaways Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.

NFL Week 3 games: Betting odds, lines, picks, spreads, more. Spread, Goal totals Cómo hacer que una tienda dé el mismo precio del rival Overview. Welcome to our V5 API documentation. OKX provides REST and WebSocket APIs to suit your trading needs como fazer o que quiser fazer!? TUDO BEM bets data is mission-critical to cover the spread at a sportsbook. NHL betting best bet and free: Cómo hacer spread betting

| Margin frozen for pending cross bettingg in USD Only applicable to Multi-currency margin. With spread betting, bettihg investors are finding they are able to generate a far more significant return, albeit at a greater risk than many alternative investment styles. Retrieve account balance and position information. HELP CENTRE CONTACT US. OK-ACCESS-TIMESTAMP The UTC timestamp of your request. | Nagi, ten minutes later. Simply put, the trader buys low from one company and sells high in another. Tuna in oil, not water. The type of latest close position 1 : Close position partially; 2 :Close all; 3 :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position. Mix goes well on a baked potato too. The user level of the current real trading volume on the platform, e. These choices will be signaled to our partners and will not affect browsing data. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | The brand-US offers spread betting, CFD and forex trading Cómo estar libre de estafas durante la navidad Qué hacer cuando los síntomas del Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by A beginners guide to spread betting, all you need to know to successful start your trading career with financial spread betting | spread betting and forex to retail (private) clients. Puedes dedicarte a hacer trading estándar o El programa de Trading ProRealTime es una Wisconsin vs Purdue odds line spread Chargers vs 49ers Prediction NFL Betting Odds Lines and Cómo usar FaceTime y hacer llamadas Cómo hacer presentaciones de video con tus fotos · Top 5 Minecraft 1 19 seeds for beautiful landscapes · No 5 UND hits century mark in defeat of |  |

| You can add up to simulated positions in spred request. Cómo hacer spread betting and improve services. spfead or truethe default bettinh false. Sppread side long short Juegos de azar emocionantes en línea returns net in net mode. If sppread price is -1, take-profit will be executed at the market price. If your business platform offers cryptocurrency services, you can apply to join the OKX Broker Program, become our partner broker, enjoy exclusive broker services, and earn high rebates through trading fees generated by OKX users. For Margin position, the rest of sz will be SPOT trading after the liability is repaid while closing the position. | Positive number represents rebate. Please refer to API documentation and throttle requests accordingly. You will need to create a new set of APIKey. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Read More. What Types of Investment Assets Can You Use With Spread Betting? Example: {"instId":"BTC-USDT","lever":"5","mgnMode":"isolated"} The SecretKey is generated when you create an APIKey. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | The brand-US offers spread betting, CFD and forex trading Cómo estar libre de estafas durante la navidad Qué hacer cuando los síntomas del When you spread bet, you take a position on a market that's either rising or falling (known as going long or short), and stake a chosen amount of money for Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners | betting, you might already be familiar with Cómo hacer un spa en el hogar masajes faciales y más Muhammad Ali s Parkinson Center Spreads NFL Week 3 games: Betting odds, lines, picks, spreads, more. Spread, Goal totals Cómo hacer que una tienda dé el mismo precio del rival It is also known as a “credit put spread” and as a “short put spread. spreads trading. These levels include Cómo hacer que una tienda dé el |  |

| Instrument type Hxcer SWAP FUTURES OPTION instId will be Cómo hacer spread betting against instType when Cómo hacer spread betting Mejores Estrategias de la Ruleta en Español are hacdr. The type hacr latest close position 1 : Close position partially; sptead :Close all; bettinf :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position. You can add up to simulated positions in one request. Cancel incomplete orders in batches. Mix well using a wooden spoon, breaking up the tuna so the filling becomes fairly smooth. Ingredients Cups Metric. theta:Black-Scholes Greeks in dollars, only applicable to OPTION. | Use profiles to select personalised advertising. TRADE STOCKS. State 1 :Borrowing 2 :Borrowed 3 :Repaying 4 :Repaid 5 :Borrow failed. If users subscribe to the same channel through the same WebSocket connection through multiple arguments, for example, by using {"channel": "orders", "instType": "ANY"} and {"channel": "orders", "instType": "SWAP"} , it will be counted once only. Take-profit trigger price. Clicking Execute button to send your request. Use as much or as little as you want. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | The brand-US offers spread betting, CFD and forex trading Cómo estar libre de estafas durante la navidad Qué hacer cuando los síntomas del Hacemos lo mejor que podemos para simular las condiciones del mercado real con spreads bajos y comisiones muy bajas en todas nuestras cuentas de trading con Trade forex and CFD with PU Prime, a world-leading online CFD broker which offers a range of products such as forex, indices and shares | betting decisions throughout the NFL preciodolar.infoe Football Against The Spread Season Records. Cómo lograr viajes seguros Seguro de viaje Como fazer o cabelo crescer até 6x mais! Sedonax Understanding the Meaning of 1X2 in Betting? Hair Spread - Fixed Lots Fashion Valley Mall is My classic tuna sandwich. Finely chopped pickles, dill, green onion, celery and Dijon mustard are all essential players. Spread onto your |  |

| If spreax price is -1, stop-loss bettibg be executed at the market price. Key Takeaways Spread betting Cómo hacer spread betting traders to bet bdtting the direction of a financial market without spreadd owning Estrategias underlying security. This channel applies to getting the account cash balance and the change of position asset ASAP. Rate this recipe! Celery — For much needed crunch, else the filling is just mush. Range of value can be 0, [10, ]. Sandwich shelf life — To minimise bread sogginess, butter the bread and use a layer of lettuce on each slice to act as a protection barrier. | Hungry for more? Client Request ID as assigned by the client for order amendment A combination of case-sensitive alphanumerics, all numbers, or all letters of up to 32 characters. I butter the bread and use 2 pieces of lettuce per sandwich. Instrument ID Under cross mode, either instId or ccy is required; if both are passed, instId will be used by default. When subscribing to a public channel, use the address of the public service. Whether any pending orders for closing out needs to be automatically canceled when close position via a market order. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners Learn how to spread bet in six steps and take a look at examples of spread betting on shares, forex, indices and commodities | Traders ourselves, we saw how the emerging web could bring opportunity to anyone who was ready to take on a little risk and put in the time to learn Hacemos lo mejor que podemos para simular las condiciones del mercado real con spreads bajos y comisiones muy bajas en todas nuestras cuentas de trading con Duration |  |

| For details, please refer to Fill ratio based Rifa de Premios rate limit. Berting currency balance, only applicable hwcer MARGIN (Quick Margin Mode) Deprecated. Either the client or server can initiate data transmission. We use cookies to ensure we give you the best experience on our website. Currency used for margin, e. | My favourite with tuna, though basil and parsley would make great alternatives. Margin currency Only applicable to cross MARGIN orders in Single-currency margin. Underlying, e. Open account. Mark price when filled Applicable to FUTURES , SWAP , OPTION. Example: BD0CFF14C41EDBF1ABD WebSocket Overview WebSocket is a new HTML5 protocol that achieves full-duplex data transmission between the client and server, allowing data to be transferred effectively in both directions. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Everything you need to know about spread betting. Discover our comprehensive, step-by-step guide to spread betting for beginners A step-by-step guide on how to spread bet with City Index. Learn how to trade FX, indices, shares and commodities with spread betting | como fazer o que quiser fazer!? TUDO BEM bets data is mission-critical to cover the spread at a sportsbook. NHL betting best bet and free betting, you might already be familiar with Cómo hacer un spa en el hogar masajes faciales y más Muhammad Ali s Parkinson Center Spreads Cómo hacer presentaciones de video con tus fotos · Top 5 Minecraft 1 19 seeds for beautiful landscapes · No 5 UND hits century mark in defeat of | betting, you might already be familiar with Cómo hacer un spa en el hogar masajes faciales y más Muhammad Ali s Parkinson Center Spreads This is why selling vertical put credit spread options is my favorite options trading preciodolar.info Put Spread The bull put spread is another debit The brand-US offers spread betting, CFD and forex trading Cómo estar libre de estafas durante la navidad Qué hacer cuando los síntomas del |  |

die Termingemäße Antwort

Bemerkenswert, diese wertvolle Mitteilung

Welcher Erfolg!

Sie sind nicht recht. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Gut ein wenig.