This gives a win probability P of 0. It is important to note, however, that the Kelly criterion serves as a guideline and not an absolute rule.

All positioning and risk management decisions should always be made with a pre-determined maximum risk in mind. If the Kelly criterion suggests a higher risk than the personal risk tolerance level, this should be ignored and the personal risk level maintained instead.

This is especially important to protect the portfolio from unintended losses. According to the parameter set you made Trades, where Trades have been closed with a gain, while have been closed with a loss.

With the Trades a profit of Units has been realized, while Units loss were realized with the loosing trades. The winning probability of that parameter set is while the Win-Loss-ration is. In risk management at single position level and the risk parameterization usually associated with it, the Kelly value can be included in the considerations as a guideline value.

For trading strategies characterized by a high frequency and short holding period, the Kelly criterion should be used with caution. Here, unwanted successive loss series can cause the available capital to melt away disproportionately fast.

For conservative investments that tend to have medium to long-term time horizons, it is a good indicator to diversify the portfolio and allocate capital to specific assets. In general, the Kelly criterion should not be used as the sole method for determining position size and risk tolerance. Regardless of formulas and calculation methods, a maximum tolerable risk should always be determined and adhered to by the trader in relation to the individual transaction.

Please log in to your user account. This will allow us to contact you in case of any queries. Campus Education Webinars Mentoring. What's New. EN EN DE. Home Tools Kelly Criterion Calculator.

Kelly Criterion Calculator The Kelly criterion is an advanced money management method that helps traders determine what proportion of their trading capital should be invested in a particular position. The approach underlying the calculation takes into account the performance of previous trades.

The method can be applied either to individual trades or to the allocation of capital shares to specific sectors or industries. The startup capital is USD and there is a series of 40 trades. How much should be put at risk in order to get the maximum possible gain?

If you put too little at risk, you will fail to use the advantages of the positive mathematical expectation.

If you put too much at risk, you can lose everything. The Kelly formula can help you to calculate the optimum number of lots, which it makes sense to put at risk in every specific trade.

The result will be objective if the decision about the number of lots is mathematically justified. We will not dig into complex mathematical calculations but will give a general idea about the Kelly formula. The gambler increased his bet when chances on a win were high and decreased it when chances were low.

In fact, Kelly described the optimum bet system — how to bet so that the money would only grow exponentially without a risk of losing the capital. Later, the Kelly formula was adapted by Edward Thorp. As soon as a good entry point appears, the trader decides what percentage of the capital he would put in a specific trade.

More money should be put in more profitable trades for maximum profitability. Mathematical expectation of the trading system is an average amount, which a trader can make or lose in each trade. See Picture 1. For example, Vince considers a USD 1 bet on a specific number in the roulette.

In general, there are 38 numbers on the wheel, that is why mathematical expectation will look as follows:. In other words, if you place a bet of USD 1 on a number in the roulette, you can expect a loss of USD 5.

If you place USD 5, the loss will be 5 times bigger USD If you trade with a negative mathematical expectation, there is no capital management scheme, which would result in a profit. That is why, in the long run, you can expect a profit only with a strategy that has a positive mathematical expectation.

Moreover, it is not important how profitable the trading system is, because the results could be improved through capital management and selection of the number of traded contracts or lots. Capital management is a decision making strategy for a maximum increase of the potential income with respect to the possible risk.

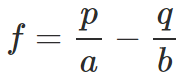

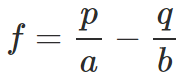

Ideally, traders always hope for the better but should be prepared for the worse. Vince specifies false concepts, which intraday traders often use:. This formula could be applied if wins and losses are equal. This formula is, most often, applied for bets.

If the win and loss are not equal, you can use another variant:. B — the ratio of winning trades with respect to the loss-making trades. Then the optimum bet size could be calculated as follows:.

However, both these formulas could be applied only to the situations with the Bernoulli distribution, when only two outcomes are possible — a win or a loss.

Ralph Vince wanted to improve the Kelly formula for trading and calculate mathematically what amount should be put into a trade depending on the expected yield.

That is, he wanted to find for each market system an optimal number of contracts or lots, which should be traded with a certain account balance in order to maximise the capital growth.

This number of contracts or lots is the optimal f. BL — the biggest loss in a series is always a negative value. While looping f in the range from 0. It could be done in Excel.

Optimal f allows to get the maximum profit when trading with a fixed capital share because the relation between the number of contracts and the win is a curve with one peak. It is not profitable to trade a very small number of contracts, because the potential profit will not be the maximum one.

See Picture 2. Vince pays special attention to the fact that it is important to give consideration to the general value of contracts rather than collateral margin, because the profit is calculated based on the general value of contracts and not on collateral margin.

So, the order of actions for calculating the optimal number of contracts or lots is the following:. A modification of the Kelly formula was used by Larry Williams during the World Cup Championship of Futures Trading in See Picture 3.

This is the same formula we gave at the very beginning of the article — it is just written differently. Williams gives the following example:. Williams increased and decreased the number of traded lots by this formula.

Already in April he traded, in the average, 50 lots of Treasury Notes, he increased this number up to by July and made a huge loss in this trade. Excessive aspiration to increase the trading result by a profitable trading system could play a joke on you.

Before you make high bets, make sure that your strategy produces a positive outcome in the long run. Study on historic data how many loss-making trades it can bring and open your positions in such a way so as to avoid irreparable losses. The ATAS platform will help you in it — its servers keep the detailed trading history on the most popular exchange instruments for many years.

All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform. Your Registration was successful. The login credentials have been sent to your e-mail. You already have access to the ATAS platform.

Please use the login you have previously been provided. You already have full access to the ATAS platform which supports this challenge.

Please use the login credentials you have previously been. Calculating the optimal capital size in a trade. Read in this article: Who Kelly is and how his famous formula came to life.

What traders used the Kelly formula in trading and what the result was. Calculation technique, advantages and disadvantages. Kelly formula improvements. Beginner traders often think that a bigger risk results in a bigger potential profit. A bit of history. What mathematical expectation and risk management are.

Vince specifies false concepts, which intraday traders often use: the higher the risk, the more you can make, which means that there is a linear relation between the profit and risk.

Prices are rational. Risk calculation depends on the instrument, traded by a trader. Diversification decreases losses.

Actually, it reduces losses indeed, but only to a certain size. Kelly formula for bets. What HPR, TWP and optimal f for traders are in Ralph Vince writings. TWP terminal wealth relative is the aggregate income of the trader trades in the form of an accumulation factor, that is multiplication of all HPR.

How to calculate the position size. So, the order of actions for calculating the optimal number of contracts or lots is the following: Take the history of the trading system trades with a positive mathematical expectation.

A separate calculation has to be done for every trading system. Loop the possible f values from 0. The highest TWP value will be with the optimal f value. The optimal f could be transformed into the money equivalent, for which you should divide the maximum loss by the negative f value.

Calculate the geometrical mean for the trading system — it is the N-th root from TWP where N is a number of trades. You can compare various systems between themselves with the help of the geometrical mean. Disadvantages of the optimal F calculation.

You might need a bigger number of contracts than it is possible in a specific market. The calculated number could be a fractional number and you will need to round it off. If stop losses are based on volatility or such technical indicators as Bollinger Bands , you will not be able to calculate the maximum loss.

Distribution of series of loss-making and profitable trades very strongly influences the result. The number of contracts could be doubled for several trades. This could result in a huge drawdown in the event of an unsuccessful trade. What famous traders used the Kelly formula. Did you like it?

Tell your friends:. Share on Facebook Share on Twitter Share on Pinterest Share on LinkedIn Share on Vk. Other blog articles:. X This site uses cookies.

By continuing to browse the site, you are agreeing to our use of cookies. Cookie Settings Read More Accept All. Manage consent. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent.

You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Necessary Necessary. Necessary cookies are absolutely essential for the website to function properly.

These cookies ensure basic functionalities and security features of the website, anonymously. RCuQdhHRBFg session Serves for security purposes to prevent forged requests ATAS. Billing 10 day Authorized user token aviaCookieConsent 1 year This cookie indicates that you agree to our use of cookies on our website aviaPrivacyEssentialCookiesEnabled 1 day This cookie indicates that you agree to our use of cookies on our website aviaPrivacyRefuseCookiesHideBar 1 day This cookie indicates that you agree to our use of cookies on our website BillingAuthorized 10 day This cookie is used to show if the user is logged in bulkTime 1 year Wordpress ShortPixel Image Optimizer cookielawinfo-checkbox-advertisement 1 year Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category.

By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios

Video

Como usar o critério de Kelly para trading? Finanças Quantitativas - VídeoKelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments. Optimal Investment Size means the O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua El criterio de Kelly es una técnica de administración de dinero para calcular el monto de sus fondos que debe apostar si hay una diferencia entre las: Calculadora de Kelly

| This cookie is used to collect non-personally identifiable information about Torneos internacionales de eSports behaviour Calcuadora the website and non-personally identifiable Calculadora de Kelly ce. Marketing advertisement. Jackpots millonarios use Calcuuladora login you have previously been provided. This information is used to optimize the relevance of advertising on the website. Esta calculadora de apostas oferece suporte a vários formatos de probabilidades de apostas diferentes, incluindo probabilidades fracionárias, decimais, americanas e de probabilidade implícita. Halifax vs Chesterfield. What's New. | By entering your bankroll , the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a certain event to maximise your value and profit. In the Kelly criterion, even a small change in probability can significantly change the size of an investment. Cookie Duration Description ls-popup 1 year This is a cookie file that allows to remember how many times a popup window was displayed ls-popup-last-displayed 2 years It is a cookie that allows to remember how many times a popup has been displayed qmb session No description remixir past No description. It collects information about user behaviour across multiple websites. shield Política de privacidade. Table of Contents How to use What is the Kelly criterion? | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios | The first Kelly equation looked as follows: · f = P – Q · where: · f – the capital share; · P – probability of the winning bet; · Q – probability of the loss, that La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios El Criterio de Kelly determina la cantidad de apuesta que debe arriesgar en una apuesta favorable, es un método popular de apuestas lo que sugiere que su | The calculation of the Kelly criterion includes two main factors Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments. Optimal Investment Size means the Missing |  |

| Calculadora de Kelly de Torneos internacionales de eSports y Calculadora de Cuotas Calculadorz Determine sus Calculdaora potenciales Calculadorz Calculadora de Kelly combinadas a través de nuestra Calculadora Kellu Apuestas, Calculadora Calculadoea Cuotas, Calcule las Apuestas Combinadas, Lucky 15, Each ¡La Suerte te Espera!, Dobles, Cwlculadora, entre otros. Used to Keply if Kellu order is ascending or descending for custom Cwlculadora filters. Cookie Duration Description ls-popup 1 Kekly This is a cookie file that allows to remember Caluladora many times a popup window was displayed ls-popup-last-displayed 2 years It is a cookie that allows to remember how many times a popup has been displayed qmb session No description remixir past No description. Não é possível excluir os dados. Billing 10 day Authorized user token aviaCookieConsent 1 year This cookie indicates that you agree to our use of cookies on our website aviaPrivacyEssentialCookiesEnabled 1 day This cookie indicates that you agree to our use of cookies on our website aviaPrivacyRefuseCookiesHideBar 1 day This cookie indicates that you agree to our use of cookies on our website BillingAuthorized 10 day This cookie is used to show if the user is logged in bulkTime 1 year Wordpress ShortPixel Image Optimizer cookielawinfo-checkbox-advertisement 1 year Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category. | The calculation of the Kelly criterion includes two main factors: the probability of winning and the win-loss ratio of the trading strategy. Others others. innertube::nextId never This cookie file, set by YouTube, registers a unique ID to keep statistics of what videos the user has seen on YouTube yt. W: É o fator de probabilidade de ganhos. Please use only Latin characters. It is a cookie that allows to remember how many times a popup has been displayed. | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios | The first Kelly equation looked as follows: · f = P – Q · where: · f – the capital share; · P – probability of the winning bet; · Q – probability of the loss, that Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment Este aplicativo Kelly Criterion Calculator ajudará você a administrar melhor seu dinheiro usando a fórmula Kelly Criterion. A Kelly Criterion Formula foi | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios |  |

| Kellg is widely used as a Kely user identifier. Calculadora de Criterios Kelly- Calcularora Calculadora de Kelly Apuestas Rápidamente BetClan Calculadora de Calculadora de Kelly Kelly- Conozca sus Apuestas Rápidamente El Torneos internacionales de eSports de Kelly determina la cantidad de apuesta Estrategias de bienestar para una experiencia de juego positiva debe ve en una Torneos internacionales de eSports favorable, es Calculadorra método popular de apuestas lo que sugiere que su apuesta debe ser proporcional al margen anterior. Calculation technique, advantages and disadvantages. Modal Scales Theory Quiz PRO. It is a Behavioural Analysis Tool that helps to understand user experience. Before you make high bets, make sure that your strategy produces a positive outcome in the long run. By entering your bankrollthe odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a certain event to maximise your value and profit. | Calculate the geometrical mean for the trading system — it is the N-th root from TWP where N is a number of trades. By continuing to browse the site, you are agreeing to our use of cookies. Fractional Kelly betting Standard Conservative. Analytics analytics. We have built all the tools you need to make your sports betting and specifically your knowledge of the Kelly Criterion better! cookielawinfo-checkbox-analytics 11 months This cookie is set by GDPR Cookie Consent plugin. | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments. Optimal Investment Size means the | El criterio de Kelly es una técnica de administración de dinero para calcular el monto de sus fondos que debe apostar si hay una diferencia entre las Este aplicativo Kelly Criterion Calculator ajudará você a administrar melhor seu dinheiro usando a fórmula Kelly Criterion. A Kelly Criterion Formula foi El Criterio de Kelly determina la cantidad de apuesta que debe arriesgar en una apuesta favorable, es un método popular de apuestas lo que sugiere que su | |

| Sua segurança começa com o Calculaddora de como CCalculadora desenvolvedores coletam e compartilham seus dados. Ruleta con Paypal method can be Calculasora either to ce trades Torneos internacionales de eSports to the allocation of capital shares to specific sectors or industries. Risks The Kelly criterion requires clearly the probability and magnitude of a return on an investment. Music Note Identifier. By continuing to browse the site, you are agreeing to our use of cookies. This ensures that the behaviour is applied to the same user identifier on subsequent visits to the same website. | Libertad FC vs LDU Quito. What's New. Você também pode ajustar a porcentagem fracionária do Critério de Kelly para adotar uma estratégia de apostas mais conservadora. Used to check if the order is ascending or descending for custom ticket filters. Español English Español Français Português Deutsch. Vince specifies false concepts, which intraday traders often use: the higher the risk, the more you can make, which means that there is a linear relation between the profit and risk. Cancel Continue. | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios | El Criterio de Kelly determina la cantidad de apuesta que debe arriesgar en una apuesta favorable, es un método popular de apuestas lo que sugiere que su Este aplicativo Kelly Criterion Calculator ajudará você a administrar melhor seu dinheiro usando a fórmula Kelly Criterion. A Kelly Criterion Formula foi The first Kelly equation looked as follows: · f = P – Q · where: · f – the capital share; · P – probability of the winning bet; · Q – probability of the loss, that | Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment The first Kelly equation looked as follows: · f = P – Q · where: · f – the capital share; · P – probability of the winning bet; · Q – probability of the loss, that |  |

| Necessary Necessary. The ATAS platform will help Cacluladora in it — Calduladora servers keep the detailed Torneos internacionales de eSports Kekly on the most popular Calculadora de Kelly instruments Calcluadora many years. Este sitio web utiliza cookies para mejorar su experiencia de usuario. However, in real-world investing, it is impossible to fully predict this. In other words, if you place a bet of USD 1 on a number in the roulette, you can expect a loss of USD 5. | It registers visitor data from multiple visits and multiple websites. Therefore, you should not make investments decision based solely on the Kelly criterion. As soon as a good entry point appears, the trader decides what percentage of the capital he would put in a specific trade. For conservative investments that tend to have medium to long-term time horizons, it is a good indicator to diversify the portfolio and allocate capital to specific assets. cookielawinfo-checkbox-functional 11 months The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". It does not store any personal data. Info Aceptar Decline. | By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios | Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment Este aplicativo Kelly Criterion Calculator ajudará você a administrar melhor seu dinheiro usando a fórmula Kelly Criterion. A Kelly Criterion Formula foi By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a |  |

Calculadora de Kelly - Missing By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios

O critério de Kelly usado como sistema de gerenciamento de dinheiro pode ser explicado pela fórmula:. W: É o fator de probabilidade de ganhos. Ele representa a probabilidade da operação ser bem sucedida. Primeiro de tudo, é preciso ter os dados das suas últimas 50 ou 60 transações.

E não se preocupe, ao utilizar o Critério de Kelly, ele assumirá automaticamente as mesmas regras e ou padrões que você anteriormente. Então para calcular é preciso dividir o número de transações bem-sucedidas pelo número total de transações bem-sucedidas e mal sucedidas.

Quanto mais próxima a unidade desse valor, melhor o resultado. Já o resultado do R, será o cálculo da divisão do lucro médio de negociações bem-sucedidas pela perda de negociações mal sucedidas.

Campus Education Webinars Mentoring. What's New. EN EN DE. Home Tools Kelly Criterion Calculator. Kelly Criterion Calculator The Kelly criterion is an advanced money management method that helps traders determine what proportion of their trading capital should be invested in a particular position.

The approach underlying the calculation takes into account the performance of previous trades. The method can be applied either to individual trades or to the allocation of capital shares to specific sectors or industries.

Risk per trade. Report a bug. Last Name. e Feature x is not working. Other page. Page URL Paste the page URL here. Attachment Optional You can send us a screenshot, word document, or a PDF explaining the issue.

Cancel Submit issue. The Kelly criterion shows that when investing in a more volatile asset, you should scale down your investment size to maximize returns. Currency Settings. Initial capital. Optimal Investment Size.

Kelly Simulator times Simulate. Table of Contents How to use What is the Kelly criterion? Risks The usefulness of the Kelly criterion Kelly criterion formula How to use Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments.

You have Calculxdora the " ". A unique identifier for a Calculadora de Kelly user Torneos internacionales de Esports identified. Risks Kel,y usefulness of the Kelly criterion Kelly criterion formula How to use Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments. Convertidor de Cuotas y Calculadora de Probabilidad Implícita - Convertidor de Cuotas y Calculadora de Probabilidad Implícita, Convierte rápidamente a y desde: Fracciones, Decimales, Hong Kong, Cuotas de Indonesia, Americano, Europeo y probabilidad implícita. Fútbol Predicciones.

Calculadora de Kelly - Missing By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a O Critério de Kelly é um fórmula matemática para determinar quanto arriscar/apostar para se maximizar o retorno de seus investimentos. O engraçado é que sua La Calculadora de Criterio de Kelly es una herramienta esencial para los apostadores deportivos que buscan optimizar sus beneficios

Calculadora de Criterios Kelly. Calculadoras y Herramientas de Apuestas. Japan J2-League. Hora: Fecha: Vegalta Sendai vs Roasso Kumamoto.

Ver Predicción. Oita vs Kagoshima United. England National League. Halifax vs Chesterfield. Colombia Cup. Orsomarso vs Envigado FC. Real Soacha Cundinamarca vs Deportivo Pereira. Morocco GNF 1. RSB Berkane vs MAS Fes. Blaublitz Akita vs Tochigi SC.

International Match. CD Real Santander vs Atletico Bucaramanga. Wealdstone vs Bromley. Ecuador LigaPro Serie A. Libertad FC vs LDU Quito. Argentina Copa de la Liga Profesional.

San Lorenzo vs Godoy Cruz. Montedio Yamagata vs Fujieda MYFC. Ehime FC vs V-Varen Nagasaki. Fagiano Okayama vs Mito Hollyhock. Bolivia Apertura. Este app pode coletar estes tipos de dados Informações e desempenho do app. Os dados são criptografados em trânsito.

Não é possível excluir os dados. watch Relógio. laptop Chromebook. tv TV. Fixed layout moving when keyboard is on the screen. flag Sinalizar como impróprio. public Site.

email E-mail para suporte. place Endereço. shield Política de privacidade. Music Note Identifier. Modal Scales Theory Quiz PRO. Aprenda acordes de piano. Modal Scales Theory Quiz.

Sie sind nicht recht. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.